The Hidden Crisis: Are Canadians Slipping into Poverty?

- Olu Olu

- Nov 4, 2024

- 3 min read

Updated: Dec 9, 2024

THE FACTS

If you do not feel the current stress of the Canadian economy, congratulations, you're part of the few lucky ones. But going by the number of people relying on food banks to survive, it is a worrisome fact that there is a growing level of financial struggle and poverty in Canada. Accorsing to Hunger Count 2024, it took around 25 years before food bank visits surpassed

1 million in a month. However, within the last 5 years alone (between 2019 and 2024), that number increased by almost 90% to 2 million visits in a single month. Since the population of Canada is about 40 million, these means that 1 in 20 people, including children and the elderly, are relying on food banks for survival.

HOW DID WE GET HERE?

Several factors have contributed to the rising levels of poverty and financial struggle in Canada.

👉🏽 The COVID-19 pandemic played a significant role, exacerbating existing inequalities and pushing many Canadians into financial hardship. The pandemic led to job losses, reduced working hours, increased living costs and spiralling debts for low-income households.

👉🏽 Additionally, the housing crisis has made it increasingly difficult for many Canadians to afford safe and stable housing. The cost of living, including food and utilities, has also risen sharply, outpacing wage growth.

👉🏽 Government support measures, while helpful, have not been sufficient to counteract these pressures, leading to a growing reliance on food banks and other social services. Government relief was also one of the reasons for inflation, high interst rate and more debts for both the country and its people.

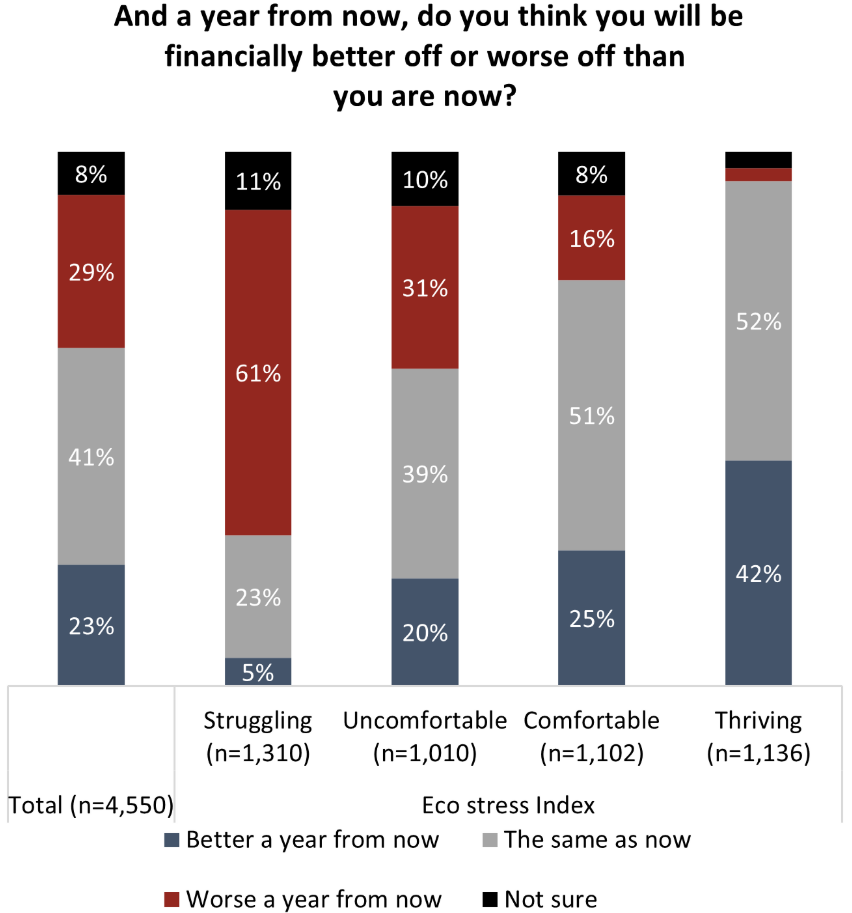

As shown above, according to a 2024 report by the Angus Reid Institute, only 23% of the surveyed Canadians believe they'll have a better financial year in 2025. It's also interesting to note that the majority of those who are comfortable and thriving right now in Canada are not confident of a better 2025.

WHAT CAN WE DO ABOUT IT?

As a financial advisor, I believe in the power of community and proactive financial planning. Here are some ways we can make a difference together:

✅ Build an Emergency Fund: One of the most effective ways to protect yourself from financial hardship is to build an emergency fund. Aim to save at least three to six months’ worth of living expenses. This fund can provide a financial cushion in case of unexpected events like job loss or medical emergencies.

✅ Seek Professional Financial Advice: Navigating financial challenges can be complex. As a financial advisor, I can help you create a personalized financial plan that addresses your unique needs and goals. Whether it’s budgeting, investing, or debt management, professional advice can make a significant difference in your financial well-being.

✅ Utilize Government and Community Resources: There are numerous government programs and community resources available to assist those facing financial difficulties. Programs such as the Canada Child Benefit, GST/HST credit, and various provincial assistance programs can provide much-needed support. Also take advantage of financial literacy workshops and community-based resources.

✅ Focus on Financial Literacy: Improving your financial literacy can empower you to make better financial decisions. Take advantage of online courses and seminars that cover topics like budgeting, saving, investing, and debt management. Knowledge is a powerful tool in achieving financial stability.

✅ Plan for the Future: Long-term financial planning is crucial for achieving financial security. Consider setting up retirement accounts, investing in wealth accounts for your children, and exploring insurance options to protect against unforeseen events. A well-thought-out financial plan can help you achieve your long-term goals and provide peace of mind.

THE BEST TIME TO ACT IS NOW!

In today’s rapidly changing economic landscape, taking proactive steps towards financial stability is crucial. By starting now, you can capitalize on compounding small amounts of money, mitigate risks, and take advantage of current opportunities. Enhancing your financial literacy and planning for the future will also help you achieve long-term goals and mitigate future money worries and overall stress.

Reach out and claim a free 30-minute session if you require more clarifications or need personalized financial advice. Together, we can build a stronger, more financially secure community.

Additional reading: https://www.thestar.com/business/dollarama-buys-land-for-calgary-warehouse-targets-2-200-canadian-stores-by-2034/article_e5e838f5-58bd-5d2d-bb4c-04c76e984017.html?lid=5md4yx8cg2iz, https://angusreid.org/fiscal-divide-canadas-struggling-thriving/, https://www.youtube.com/watch?v=TjXNqGWh2rI

Comments