top of page

Stay up to date with our blog posts

100 Years of Investment Growth - S&P 500 Lessons

As a financial advisor, I am often asked: "Is the market a gamble?" When you look at the headlines of a single week, it certainly feels like one. But when we zoom out to a 100-year view (1926–2025) , the "noise" of the daily news transforms into the "signal" of one of the greatest wealth-creation engines in human history. Let’s look at the cold, hard data from the last century and what it actually means for your portfolio. 1. The Power of 10.49% Over the last 100 years, the

3 min read

Corporation-Owned vs. Personal Life Insurance in Canada

If you own a business in Canada, the question of whether to hold life insurance personally or through your corporation can have big consequences for taxes, estate planning, and long-term wealth. Below is an overview of how each option works and when one may be better than the other. Comparison: Corporate-Owned vs. Personal Life Insurance Category Corporate-Owned Life Insurance Personally-Held Life Insurance Who owns the policy Corporation (typically a CCPC) Individual (busine

2 min read

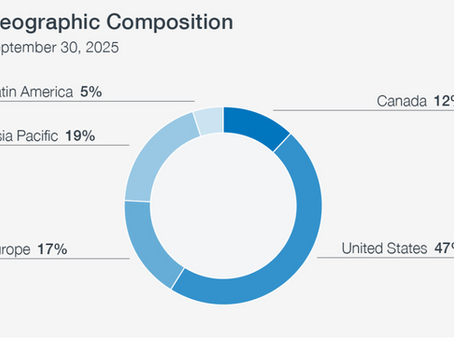

How Is Your Canadian Pension Plan Invested? Part 2 of 2

When Canadians think about investing, it’s common to focus on what’s familiar like the Canadian stock market, local real estate, maybe a few big U.S. companies. But the Canada Pension Plan Investment Board (CPPIB) , which manages retirement funds for millions of Canadians, doesn’t stop at our borders. Their approach tells us something important: diversification isn’t just about what you invest in, but also where. CPP Investments: A Global Strategy As of September 30, 2025 , h

2 min read

Address

Unit 4 – 1680 Ellice Ave

Winnipeg, MB R3H 0Z2

Call

+1 (204) 521-0752

Follow

Copyright © 2024 Wealthy Canadian 101 | All rights reserved.

bottom of page