You Must Open Your FHSA Now (if eligible)!

- Olu Olu

- Oct 22, 2024

- 3 min read

Updated: 5 days ago

The First Home Savings Account (FHSA) is quickly emerging as one of the most tax-advantaged financial tools available in Canada. Introduced in 2023, the FHSA combines the best features of both RRSPs and TFSAs, offering Canadians an unmatched opportunity to save for their first home. You can also make a direct transfer from your RRSP to your FHSA without immediate tax consequencies. Now, that's a golden opportunity to save some taxes.

With a modest income of $60,000 and interest rate of just 3%, the image below shows the amount of taxes you can save if you have a First Home Savings Account.

WHY YOU NEED TO OPEN YOUR FHSA TODAY

Opening a First Home Savings Account (FHSA), as soon as you become eligible, is a very smart financial move for several reasons:

1. Maximize Contribution Room

Immediate Contribution Room: By opening an FHSA in the same year you become eligible, you immediately gain $8,000 contribution room. And you can carry forward up to $8,000 into the next year to make it a total of $16,000.

2. Tax Benefits

Tax Deductions: Contributions to an FHSA are tax-deductible, reducing your taxable income for the year.

Tax-Free Withdrawals: When you use the funds to purchase your first home, withdrawals are tax-free, including any income earned from interest, dividends, or capital gains.

3. Flexibility and Growth

Investment Options: An FHSA can hold a variety of investments, such as guaranteed investment certificates (GICs), exchange-traded funds (ETFs), and more, allowing your savings to grow tax-free.

No Immediate Contribution Requirement: You can open the account now to secure your contribution room without needing to contribute immediately.

4. Long-Term Planning

15-Year Window: You have up to 15 years to use the funds for a home purchase, providing ample time to save and plan.

Lifetime Limit: The lifetime contribution limit is $40,000, which can significantly boost your down payment savings.

5. Strategic Timing

End-of-Year Advantage: Opening the account before December 31st ensures you don’t lose out on the contribution room for the current year.

BEWARE OF THE NON-TAX DEDUCTIBLES

❌ Contributions made after the first qualifying withdrawal cannot be deducted on your income tax and benefit return for any year.

❌ Any contributions to your FHSAs that exceed your lifetime FHSA limit of $40,000 cannot be deducted on your income tax and benefit return for any year.

❌ Unlike RRSP, contributions you make to your FHSAs during the first 60 days of the year cannot be deducted on your income tax and benefit return for the previous year. You can deduct them the next year if other conditions are met.

❌ If you have an excess FHSA amount after your maximum participation period has ended and you have not reached your lifetime FHSA limit of $40,000, you may have to forfeit the rest. This is because after your maximum participation period has ended, your annual FHSA limit is $0.

HOW TO GET STARTED

Understanding how to leverage the FHSA is essential for Canadians looking to make homeownership a reality. Here are a few simple steps to follow:

Confirm Eligibility: The first step is to check the CRA website to confirm your eligibility (Canadian resident, 18+ years old, and a first-time homebuyer). While you're there, also take time to understand how it really works or contact us for more guidance.

Open an FHSA: Choose a Financial Institution to open an FHSA immediately after confirming eligibility. You do not need to contribute funds into it immediately but opening the account gives you a contribution room to carry forward into the next year.

Contribute Regularly: When funds are available, maximize your annual contributions up to $8,000 (with a lifetime limit of $40,000), and carry forward unused contributions.

Invest Wisely: Grow your savings by investing in eligible assets like stocks, bonds, or mutual funds within your FHSA to benefit from tax-free growth.

Claim Tax Deductions: Contributions are tax-deductible, reducing your taxable income for the year.

Use Savings for a Home Purchase: Withdraw tax-free from your FHSA when you're ready to buy a qualifying first home.

Combine with Other Programs: If needed, use the FHSA alongside your Tax-Free Savings Account (TFSA) and Home Buyers’ Plan (HBP) from your RRSP for additional down payment support.

Contact us today to take advantage of the best savings and investment opportunities! Bonus: CRA FHSA Calculator

Additional reading: CRA, RBC, BMO, Department of Finance, Registered Investments, CRA, https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/first-home-savings-account/transfers-into-your-fhsas.html

Other Comparatives:

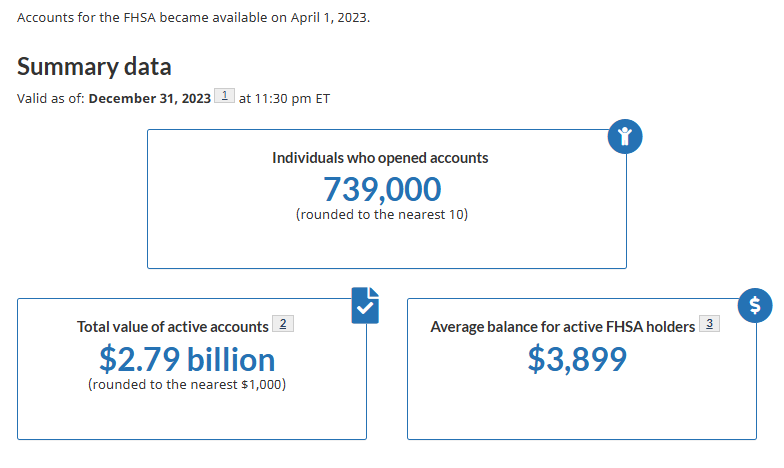

CRA Statistics:

Comments