Do Homebuyers Need Insurance? - Maybe, Maybe Not

- Jun 18, 2025

- 1 min read

Updated: Jun 19, 2025

Buying a home in Canada isn’t just about closing the deal — for many people, it’s about protecting the biggest investment of your life. While most people think of home insurance as just "fire protection," the truth is, there are multiple layers of risk that can impact your property, your finances, or even your family’s future.

But with so many options, where do you start?

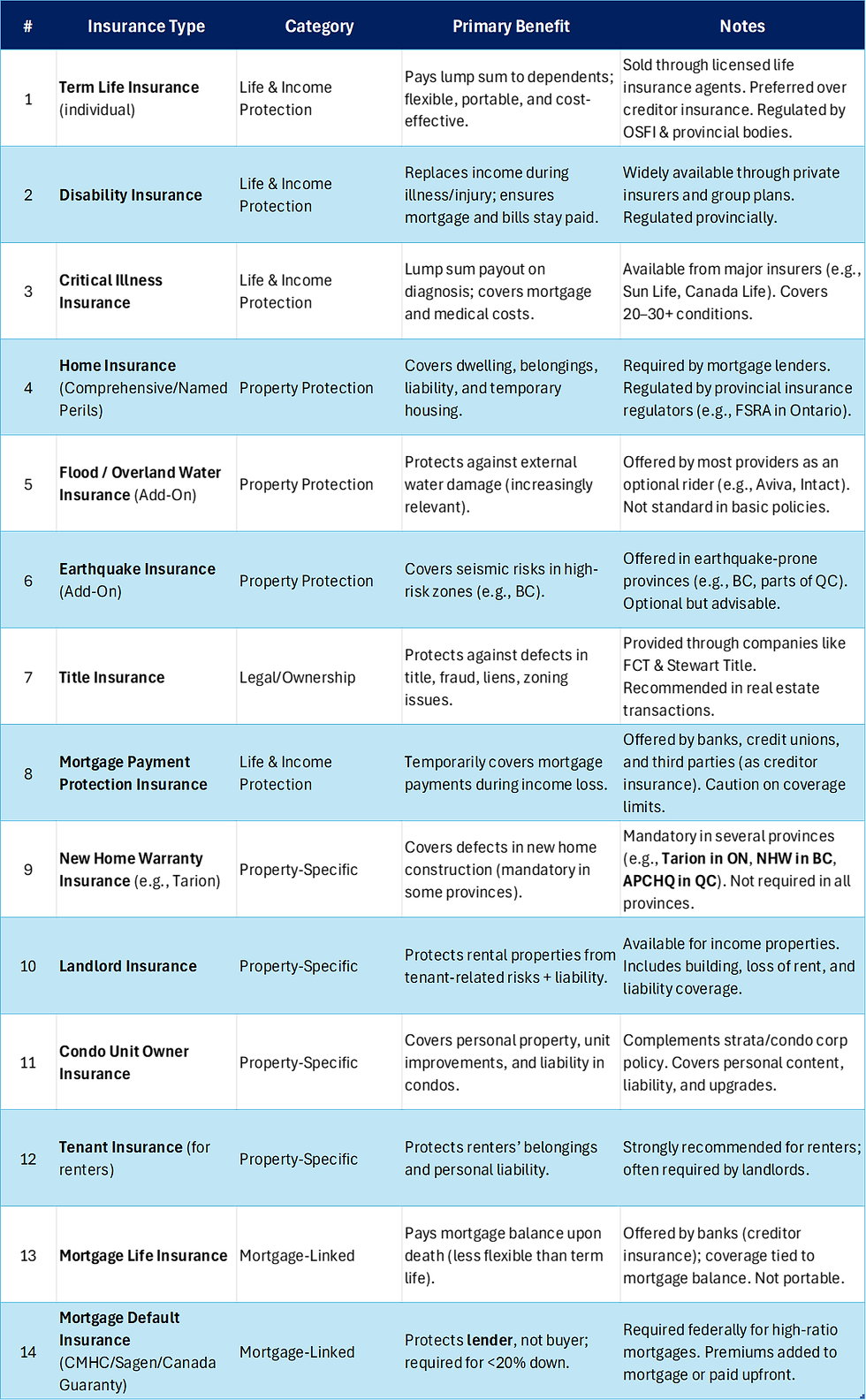

Below is a comprehensive table outlining the 14 key types of insurance every Canadian homebuyer and homeowner should consider — organized by how much they benefit you as the buyer, not just the bank.

Let’s break it down:

In summary,

term life insurance is most benficial for individuals because it protects the entire value of the property while also being portable, flexible and very affordable. It can also be layered with a permanent insurance with investment and cash value benefits.

the mortgage default insurance is the least beneficial to homebuyers because it only benfits the lender (e.g. bank) but it is mandatory if the homebuyer is paying between 5% - 20% downpayment.

home insurance is required by lenders because your mortgage is secured by your home, meaning the lender has legal rights over the property. If you don’t repay the loan, they can sell it to recover their money — so they require insurance to protect their financial interest.

Reach out for more homebuying tips and to set up the right insurance coverage for your property.

Comments